Are We Really Looking at China?

Hispanic brands have several tasks on which they have to catch up regarding China as soon as possible

The luxury market in the Asian giant has only just begun. Not much longer than 10 years ago, China began to take a series of measures to revive its economy and open progressively westward. However, despite all the news we receive, the reality is that the door is not fully open, it is only ajar to let some brands come and go.

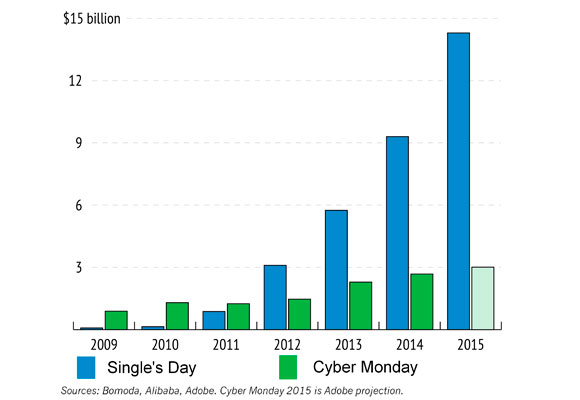

Nevertheless, their numbers have grown steadily to become the world’s largest economy and with overwhelming results that have darken and even ridicule the greatest achievements of the West. And if you don’t believe it, you just need to take a look at Single’s Day, invented seven years ago by the powerful Alibaba, which raised $ 14.3 billion in just 24 hours. Adobe expectations around Cyber Monday this year are only $ 3 billion, less than a quarter.

Precisely, this was the main topic discussed in the radio show’s “Todo es Economía” last Friday conducted by Javier Santacruz and Rafael Molina, in which participated four members of The Luxonomist: Marcos Mosteiro, Miguel Ángel Abad, Daniel Nicolás and myself.

Only this information (together with its graphic) gives us an idea on how the future will look in the coming years. According to Hurun’s 2014 Wealth Report, in 2013 there were 1.09 million millionaires and 67,000 super rich in China, growing around 3.8% yoy compared to 2012. And these numbers will continue rising in the coming years, as it is doing today the middle class, with over 109 million people, topping the world rankings even the all-powerful United States, with nearly 92 million Americans, according to Credit Suisse’s Global Wealth Report. In Spain, the middle class is close to 21 million people, almost 50% of the total Spanish population.

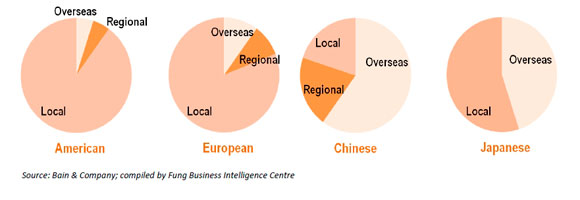

Bain & Company estimated that Chinese visitors spent up to 209 million yuan on luxury goods abroad in 2014. As shown in the picture, Chinese consumers spent abroad three times more than they did locally.

On the other hand, the total amount of purchases by Chinese through online platforms abroad reached, according to Fung Business Intelligence Centre, 74.4 billion yuan in 2013, up from 12 billion yuan spent in 2010, and by the end of 2014 they predicted that would reach 140 billion yuan, more than 20 billion dollars.

The 10 preferred countries by Chinese to do their online shopping via transnational online platforms are by volume of purchases: United States, South Korea, Hong Kong, Malaysia, the Netherlands, Denmark, Japan, Taiwan, United Kingdom and Sweden. In short, because of the high taxes on luxury goods, three scenarios are happening right now in which Spanish-speaking brands need to start taking positions:

- Chinese are the biggest spenders when traveling abroad and yet, the vast majority of western shops and tourist receivers do not have Chinese interpreters, nor their staff have minimal knowledge of the language, or even of China’s culture.

- Chinese are the biggest spenders on their own online platforms, which outperform the rest of online platforms worldwide. Not only they have their Single’s Day, but also they have adapted easily to Black Friday and Cyber Monday so that its sales figures have surpassed those of the West. However, the presence of Spanish-speaking brands at major online platforms like Tmall, Mei.com or Mbaobao is quite low, almost nil.

- Chinese are increasingly spending more on international online shopping platforms in order to obtain better prices even with international transport. But again, the presence of Spanish-speaking brands in the Chinese versions of Amazon, Macy’s or Net-a-Porter remains imperceptible.

Hispanic brands have several tasks on which they have to catch up regarding China as soon as possible and leave behind the mentality of the XXth century to enter directly into the XXIst century or otherwise, at the speed events are happening, the cost of catching up might achieve unviable levels to assume for brands, with the risk that it entails.

Disclosure: The Luxonomist is not responsible for the views expressed in the article. The text was written freely expressing ideas, without receiving any compensation. The author has no business relationship with any of the companies whose shares are listed in this article.