A Shining Path for Jewelry?

Most analysts predict a rosy future for the jewelry industry worldwide.

Annual global sales of USD 210 billion are expected to grow between 5 and 6 percent each year, totaling USD 413 billion by 2020. Consumer appetite for jewelry took a hit during the global recession to now become almost insatiable. Such growth flies on the tail winds of:

- Emerging rich consumers who wear branded jewelry to let the world know they are wealthy. They, of course, are in sharp contrast to Old Money consumers who are passionate about heirlooms or estate jewelry;

- Emerging-market consumers, for whom established brands inspire trust and the sense of an upgraded lifestyle;

- Young consumers who turn to brands as a means of self-expression and self-realization. These consumers expect jewelry to be a companion in their life journey to mindfulness and soul search.

Of these three segments, the fastest growing is the third which represents a hybrid between custom and fine; branded and local and; modern and old jewelry. To be sure, the Millennial segment demands the same set of talents as recent success stories in the apparel industry such as Zara and HM. The value chain must be short so as to easily detect consumers desires and effortlessly transform them into products that are placed in shelves fast enough to fulfill a short life cycle before the next whim rises.

Designs have to be inspiring and attractive; stones need to carry a spiritual significance (emerald, compassion, abundance; alexandrite joy; moonstone, patience; aquamarine, peace) and materials need to effortlessly blend in a simple yet elaborate creation. Themes abound. Nature and wildlife are greatly appreciated but also are all forms of prayers.

Mantras; meditation readings and magic spells written in gold, silver or copper and embellished with the addition of one or two stones carry the day for Millennials. But they also enjoy carrying what would be the equivalent to «fast fashion». That is to say pieces of jewelry that have a low intrinsic value but that are sold at hefty margins because they confer to the bearer a sense of generational identity. Among these items one can count the silk braid bands that have been adopted by young consumers including the Duke and Duchess of Cambridge who flaunt in their wrist these shinny pieces of jewelry. Production costs for these items are about US 2. But hey sale for US 20.

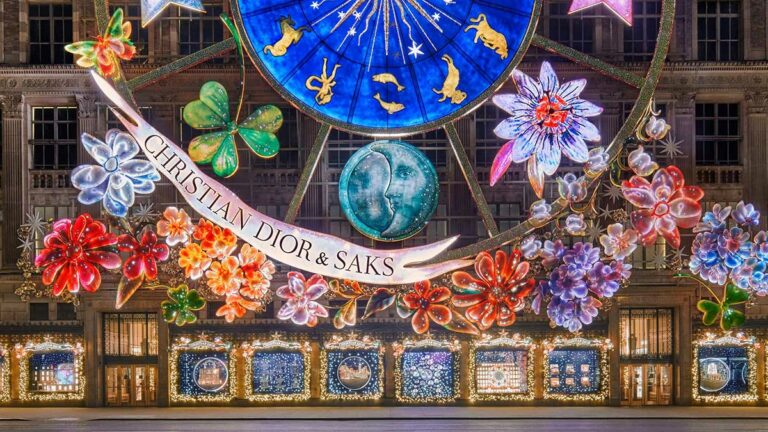

As a result, from the Millennial irruption into the jewelry market the previously clear-cut boundaries between fine jewelry (characterized by the use of precious metals and stones) and fashion jewelry (typically made of plated alloys and crystal stones) have withered. Buying patterns are also affected as fine jewelry that used to be almost exclusively a gift purchase is being now bought for use by acquirer. Some fine jewelry is available at bargain prices at jewelry wholesale markets. Chanel and Dior, on the contrary, sell fashion jewelry for thousands of euros.

And yet another Millennial induced trend in jewelry is the internationalization of designs and brands. Continuous traveling and unending internet exchanges have triggered demand for jewelry products that had been considered as local until very recently. Nepal’s praying beads for instance are the most sought after piece to adorn a Millennial neck. Thailand’s essence capsules are the perfect finishing touch for decorative chains. African coconut skin is becoming the most popular input to manufacture handcuffs; pins, cups and drinking glasses.

These materials have seen their price rise about 15% over the last decade. In short, 2020 will probably see a rise in the volume of demand for jewelry and the consolidation of about 12 international jewelry brands accounting for 40% of the market and serving the emerging rich and the consolidated middle classes and the fragmentation into small local producers of the remaining 60% of the jewelry market which will serve the fast changing whims of Millennials.