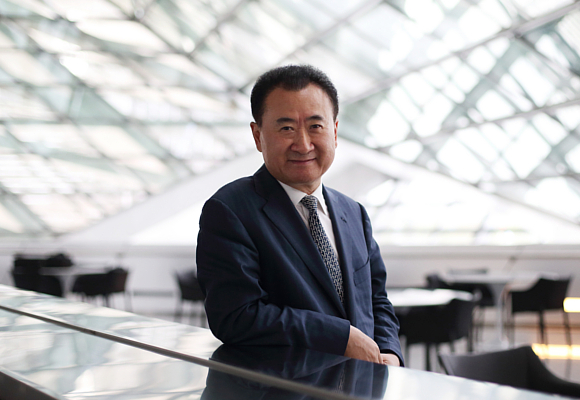

Wang Jianlin Surpasses Li Ka-shing as Asia’s Richest Man

Besides Dalian Wanda Commercial Properties, Wang Jianlin also holds a 60.71% stake in A-share listed Wanda Cinema Line (002739.SZ) through Wanda Investment Co., Ltd, which had a market value of around RMB 57.2bn based on the market cap of Wanda Cinema Line on May 4.

Dalian Wanda Group Chairman and businessman Wang Jianlin has surpassed Hong Kong investor Li Ka-shing as Asia’s richest man, thanks to the rising listed A-share and H-share prices of Wanda Group in recent months. With a fortune of US$38.1bn, Wang therefore simultaneously overtook Li as the richest person in China,according to data from the Bloomberg Chinese Rich List and Asia Rich List as of May 1, 2015.

On that day, Wang Jianlin was ranked 11th richest in the world, Alibaba Group founder Jack Ma was 17th with wealth of US$35.1bn, and Li Ka-shing was 19th with US$34.7bn. Wang’s ranking surpassed that of both Li and Ma in late April. According to earlier released rich lists by Bloomberg and Forbes, Wang Jianlin had a fortune of only US$24.2bn, showing that the sharp increase in the market cap of Wang’s three listed companies during this period has become a key driver of his soaring wealth.

On May 4, shares in Dalian Wanda Commercial Properties (3699.HK), a Hong Kong-listed company of Wanda Group, soared to HK$68/share after opening, pushing its market cap to above HK$300bn for the first time. Given that Wang and his family hold 2.43 billion shares of Dalian Wanda Commercial Properties through Wanda Group, the market value of the shares of Dalian Wanda Commercial Properties held by him and his family alone already exceeds US$20bn.

Besides Dalian Wanda Commercial Properties, Wang Jianlin also holds a 60.71% stake in A-share listed Wanda Cinema Line (002739.SZ) through Wanda Investment Co., Ltd, which had a market value of around RMB 57.2bn based on the market cap of Wanda Cinema Line on May 4.

In addition to the above two listed companies, Wang Jianlin also holds a 78% stake in AMC, a US-listed cinema operator with a market value of about RMB 14.5bn, based on share prices on May 4, bringing the value of Wang Jianlin’s stakes in the three listed companies to nearly RMB 200bn or US$32bn.

Notably, shares of both Dalian Wanda Commercial Properties and Wanda Cinema Line surged in April, with the former climbing 33% and the latter 74%.

With respect to the two companies’ performance on the capital markets, some industry analysts believed it was mainly due to investors’ reassessment of their valuations. In particular, Wanda Group’s recently proposed strategy of its fourth restructuring, i.e. from «asset-heavy» to «asset-light», has helped ease the financial bottlenecks that have long inhibited Dalian Wanda Commercial Properties’ expansion speed. Investors will thus also re-evaluate Dalian Wanda Commercial Properties’ speed of asset expansion.

Additionally, with Wanda Group’s growing presence in culture, tourism, e-commerce and finance, Wanda Group will construct a closed ecosystem that consists of customer traffic, logistics, capital flow and information flow based on offline consumption.

«With its massive commercial properties in the mainland, we believe Dalian Wanda Commercial Properties will benefit from the central government’s policy to boost domestic consumption. Given Wanda’s powerful brand influence in China, its retail property will be favored by domestic and overseas retailers. We believe as its commercial properties mature, there is still room for Wanda to raise rents.» UBS analysts project in their research report that Dalian Wanda Commercial Properties has a target price of HK$77.95/share, and they reiterate their «BUY» rating.