Welcome HolaBank

CaixaBank launches HolaBank, seeking to establish itself as leader among international clients in Spain.

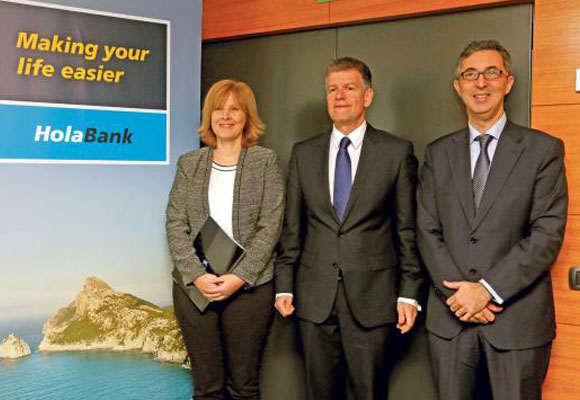

CaixaBank unveiled a new business line aimed at international clients, seeking to establish the bank as the leading financial provider to this group.

The bank, overseen by Chairman Isidro Fainé and CEO Gonzalo Gortázar, has thus set up the HolaBank brand. This is a new service model tailored to said client group, featuring 100 branches staffed by experts in international banking and high value financial guidance. It also offers a portfolio of financial and non-financial products and services to address the specific needs of such clients.

HolaBank is aimed at international clients who have bought or rent property in Spain, residing in the country permanently or over part of the year. These tend to be families who have bought holiday homes, investors, business people, professionals or retirees. They are usually of European origin, but also from elsewhere in the world, and have moved to in Spain for business or leisure purposes.

CaixaBank currently serves 375,000 clients in this segment, generating business volumes standing at 6.0 billion euro (figures as of February 2015). By setting up this business line CaixaBank aims to secure market penetration of 25% among international customers over the next four years, in line with the bank’s 2015-2018 strategic plan.

A leader in innovation and service quality

Juan Antonio Alcaraz, Chief Business Officer at CaixaBank, said “HolaBank will allow CaixaBank to bolster its relationship with this group of clients, which have highly specific demands and require an innovative, comprehensive and high quality range of products and services”. He went on to say, “By stepping up our focus on this client segment we will fortify CaixaBank’s leadership in retail banking in Spain».

HolaBank will initially include 100 branches in Malaga (16), Alicante (16), Murcia (5), the Balearic Islands (38), Las Palmas (12) and Tenerife (13), covering 72 municipalities in all. As well as specialised customer service, provided by multilingual account managers, documentation at these branches will also be available in several languages. These branches will be rebranded to ensure they are easily recognisable to clients.

This new CaixaBank service features an extensive catalogue of savings and financing products designed specifically with this group in mind, as well as a broad portfolio of high value non-financial services. These include the so-called Plan Living Solutions, providing legal guidance in multiple languages, telephone healthcare assistance in multiple languages, online translators and interpreters, free registration with utilities, personal assistance and emergency home support under special circumstances, among others. They will also be able to benefit from discounts and promotions at restaurants and an exclusive telephone service line, available 365 days a year.

The www.holabank.es website will be available to international customers, featuring the full range of HolaBank services in English, German, French, Spanish and Catalan. They will also be able to directly contact account managers in their own language.

Multichannel management: Operations 24 hours a day

CaixaBank’s multichannel banking strategy means HolaBank customers will be able to operate with their accounts 24 hours a day, seven days a week, via branches, existing electronic channels such as ATMs, smartphones (CaixaMóvil) and Internet (Línea Abierta), and new devices and environments, such as tablets, smart TVs, social networks, etc.

CaixaBank is currently Spain’s foremost bank in electronic banking and a global leader in terms of innovation. 4.7 million customers use the bank’s online services each month according to ComScore. More than 2 million customers also operate using mobile devices each month. The mobile app download service has been used to make 10 million downloads.

CaixaBank’s online banking share stands at 36%, the highest worldwide (comparing penetration rates for banks in their respective markets). CaixaBank became the first bank to create its own mobile app store, featuring more than 70 free applications compatible with the various mobile operating systems. Such applications allow users to harness services available via other channels using their mobile devices. Examples include applications for making transfers to deposits or investment funds via mobile devices.

Awards for customer management

This commercial strategy consolidates CaixaBank’s position as a leader in innovation and service quality. CaixaBank is the leader in the Spanish banking sector, with 13.4 million customers, a penetration rate of 27.6% and a network of more than 5,000 branches and close to 10,000 ATMs, the most extensive in Spain.

In February CaixaBank received two important awards in London for service quality in customer management and consultancy. On the one hand, it won the award for the best private banking provider in Spain from the British magazine Euromoney, as part of the Private Banking Survey 2015, which identifies the top private banking institutions in terms of service quality and business models.

The bank also received the award for excellence in financial consultancy from Alan Yarrow, Lord Mayor of London and Chairman of the Chartered Institute for Securities & Investment (CISI), in recognition of CaixaBank’s foresight in anticipating the European regulatory requirements that would be introduced with the launch of the European Banking Union. The bank was the first in the Spanish financial sector to certify employee training based on the postgraduate diploma in financial consultancy from the UPF and the CISI’s Certificate in Wealth Management.

Welfare projects: 9.5 million beneficiaries and more engagement than ever

“la Caixa” Banking Foundation will earmark a budget of 500 million euro for Welfare Projects in 2015, the same sum as dedicated to such projects for the last seven years. This allocation makes the bank the largest private foundation in Spain and one of the most important anywhere in the world.

These projects will continue to concentrate on current major challenges, such as unemployment, preventing exclusion and supporting access to homes. The lion’s share of investment, 67.1% of the budget (336 million euro), goes towards social and care services; cultural programmes account for 13.5% of investment (67 million); science and environmental programmes 11.2% (56 million); and support for education and research 8.2% (41 million euro).