India, the new global luxury centre

India is not already a “dormant giant” in the Chinese luxury shadow.

India is the new centre of attention of global luxury market. This fact has been observed by the most important market agents (brands, companies…) which are introducing now themselves in the Indian market with new models or brands that fit better with national preferences. This trend has been reflected in “Analyzing India’s Luxury Market 2015”, a new report made by the research firm “Research and Markets”.

The slowing economic growth in China has left India as a powerful and innovator market with an economic and demographic growth above global average. India has been a “secondary character” under the shadow of China until now. However, the fast increasing in the urban middle class with the growing number of high net worth individuals, are pushing up sector growth up to approximately 18% in annual terms.

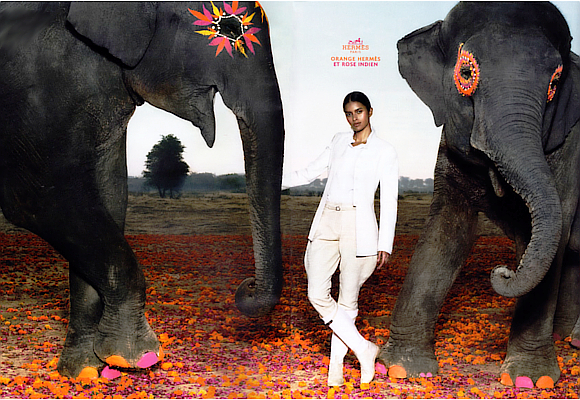

As we told before, main brands such as Louis Vuitton, Burberry, BMW, Hermès, Gucci, Daimler and TAG Heuer, has been introduced in the Indian market with a very positive prospective in present and future results. In particular, jewelry brands have a unexplored market with an explosive demand: gold jewelry and ornaments.

The massive utilization of gold and silver in familiar celebrations and social events has attracted a huge number of foreign investors thanks to price differences between national and international market, apart from the growth of billionaires and high-income families. Right now, the gold premium in India is between USD 2 and USD 3 per ounce. This premium can be higher or lower depending on seasonal effects.

2013 and 2014 were two key years in the Indian gold market. Between May and June, 2013, the former Indian government had to intervene the balance of payments with restrictive measures over gold imports –a 10% tax on gold imports and the obligation of re-export 20% of imported gold– in order to stop currency outflows and the increasing current account deficit at historical levels of 7% of GDP.

Two years later, gold demand continues increasing as inflation rate rebounds too. After dropping to a half in one year, inflation rate of consumption goods is hiking reaching levels close to 5.5% (5.37% latest data of February). It constitutes an opportunity to invest in “safe havens” such as gold, silver or, in general, luxury goods to protect wealth.