Swiss: Happy New Year !!!

Last Thursday the central Swiss bank lowered the interests rates to the -0,75% and removed the Swiss franc

When we were still designing the list of new proposes for the year, arguing if the bascule is overweight, suffering the effects of scoundrel flu or waiting like “Penelope” his Odiseo, Mario Dragui, the central Swiss bank, has convulsed the financial markets surprisingly.

Last Thursday, by surprise, the central Swiss bank lowered the interests rates to the -0,75% and removed the Swiss franc minimum exchange rate versus the Euro, which was located in 1,2 Francs. For laymen, I will try to explain the reasons why this decision was taken, their short term effects and, above all, their influence in the luxury sector.

Three years ago, with the Euro crisis and the transfer of capital to Switzerland, the Swiss franc, entered in a spiral of dangerous revaluation for the country, what caused that, their Central Bank, sell Swiss Francs and buy Euros in the proportion of 1,2 Francs per Euro. Such operations are unlimited, since the issuance of the Swiss currency is up to the government. This caused an increase of Swiss Francs in the market, and therefore, distortions in the Swiss Economy.

Now, with the application of this decision, the entry of outside capital is penalized with negative interests rates (the saver not only doesn´t receive interests, but pays a 0,75% for the deposited amount ) and has, the BNS, the ability to intervene in the Forex market on a discretionary way.

If addition, it is expected that the European Central Bank increases in a billion the amount of Euros in circulation and that a significant amount might go to the Swiss market , within the sharp devaluation of the Euro facing the Dollar and the major global currencies, is no longer justified to maintain the minimum change.

If the decision is correct, the market has been “caught” by surprise, as is reflected that, after news, the Franc traded 0,8 against the euro, the European stocks were stained red (see the weekly index Eurodeal-The Luxonomist inform), and the Swiss stock plummeted more than a 6%.

One of the biggest affected by this decision were the watchmaking companies leaders, Swatch and Richemont. With most of their income generated out of Swiss, while most of their costs are within, and the no coverage of the currency risk by their financial area, this decision has torpedoed their waterline.

If in 2015 already seemed difficult for both with the appearance of competitors such as Apple Watch, this new situation makes us more cautious when valuing, waiting for next month, with the year-end data to make our assessments. We are left with the CEO words of Swatch, Nick Hayek, saying “it had no words” and consider that the performance of the Central Swiss Bank was a “tsunami” for the Swiss export industry.

See the technical analysis of both

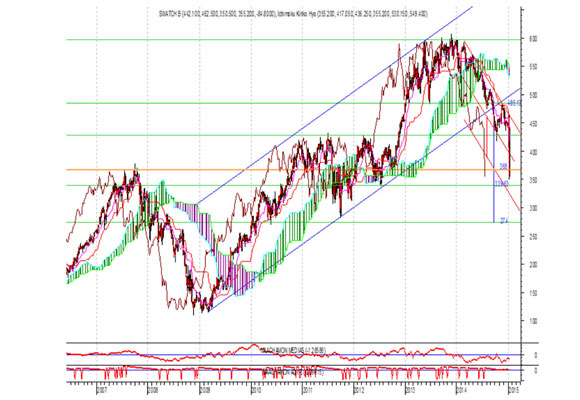

Swatch

As we can see in the weekly graphic, we are in a bearish channel since the breakup of the bullish channel, last September. After news of BCS, this bearish channel has unfolded (red color), indicating the strength and violence of the new movement. The weekly close, below the first objective (orange line), 368 CHF, gives us an object of fall that sits around 274 CHF, with next resistances in 339.63.

The trend indicators are very negatives, while the relative strength supports sales value. As we can see, Ichimoku anticipated this downward movement two weeks ago, behind the narrowing and the reversal of his cloud.

If we analyze the daily graphic: We can observe the gap or hollow left in Fridays last session, in the level 375.5 CHF, fundamental support for seeing short-term recoveries in value.

In brief, with a weekly close, below the first objective (orange line), 368 CHF, won’t surprise us new falls to 274 CHF. Only rises above the 450 would make us change our mind.

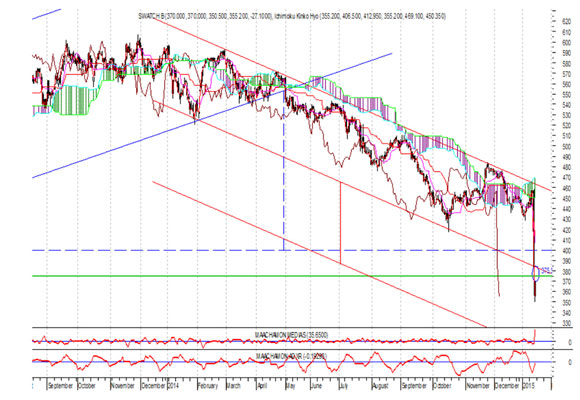

Richemont

If we analyze Richemont´s weekly graphic: The trend and relative strength indicators advise us, by the moment to be out of the value. Is significant the narrowing of Ichomokus cloud, coinciding with the price break, what proves us the possibility of new assignments.

We don´t discard new assignments to levels of 55.54 CHF after the 75.00 support break.

“The cautious man never regrets the present evil; uses the present in preventing the future tribulations”, Shakespeare.

Analysis: Miguel Angel Abad Chamón, Minister of Eurodeal SV maabad@eurodeal.es

Disclosure: This report is provided for information purposes. The opinions contained in it are based on information obtained from sources believed to solvents but we can not guarantee its accuracy and correctness. Our opinions are discharged at a given time and are subject to change over time. Eurodeal not accept any liability for losses to follow the recommendations expressed in this report.